The Latest from Growpay

Growpays outlook on the future of payments.

Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them

Zeller Launches Tap to Pay on Android, Boosting Business and Consumer Adoption

Great news for Australian businesses! Zeller, a fast growing payments company, has launched Tap to Pay on Android, making them the first homegrown fintech to offer this innovative contactless payment solution. This means businesses can now ditch the extra hardware and accept payments directly from their Android smartphones using the Zeller App. Faster Transactions, Happier Customers: The news comes on the heels of a successful Tap to Pay launch on iPhone in October 2023. Businesses have embra

Lightspeed Streamlines Operations for Retail and Restaurant Businesses

Lightspeed Commerce, a leading Point of Sale (POS) and payments platform for ambitious entrepreneurs, unveiled a suite of new features designed to help retailers and restaurants simplify operations, scale their business, and deliver exceptional customer experiences. “With inflation remaining a chief concern amongst hospitality and retail providers, Lightspeed has focused on innovations that improve speed and efficiency, reducing the overall time and stress related to daily business management,”

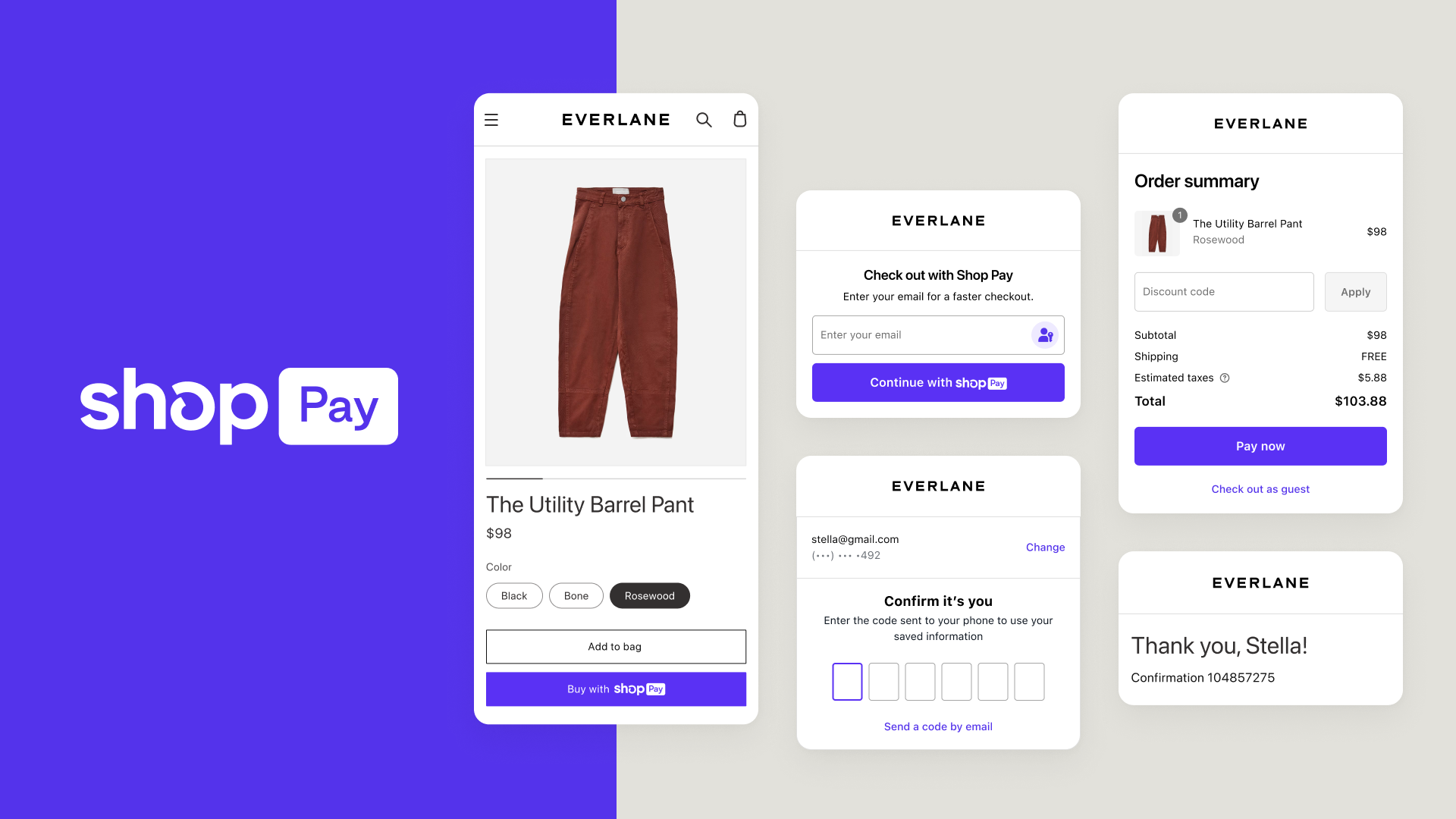

Shop Pay can now be Integrated with other Commerce Platforms.

Big news for online retailers! Shop Pay, the popular and fast-converting checkout solution from Shopify, is making its magic accessible to everyone. Previously limited to Shopify stores, Shop Pay is now available as a Commerce Component, allowing any business to integrate its seamless checkout experience into their existing platform, regardless of whether they use Shopify. This is a game-changer for businesses looking to boost conversion rates and improve customer satisfaction. Shop Pay has a p

Riskified Maximises Revenue Recovery for Businesses.

For online merchants, the post-holiday season often brings not just cheer, but also a dreaded surge in chargebacks. Battling payment disputes can be a time-consuming, manual grind, eating into profits and leaving valuable resources drained. But fear not, for Riskified has arrived with a mighty weapon; an expanded chargeback management system that promises to revolutionise the game. Introducing Dispute Resolve: Your Chargeback-Crushing Ally Imagine a world where disputing chargebacks is effort

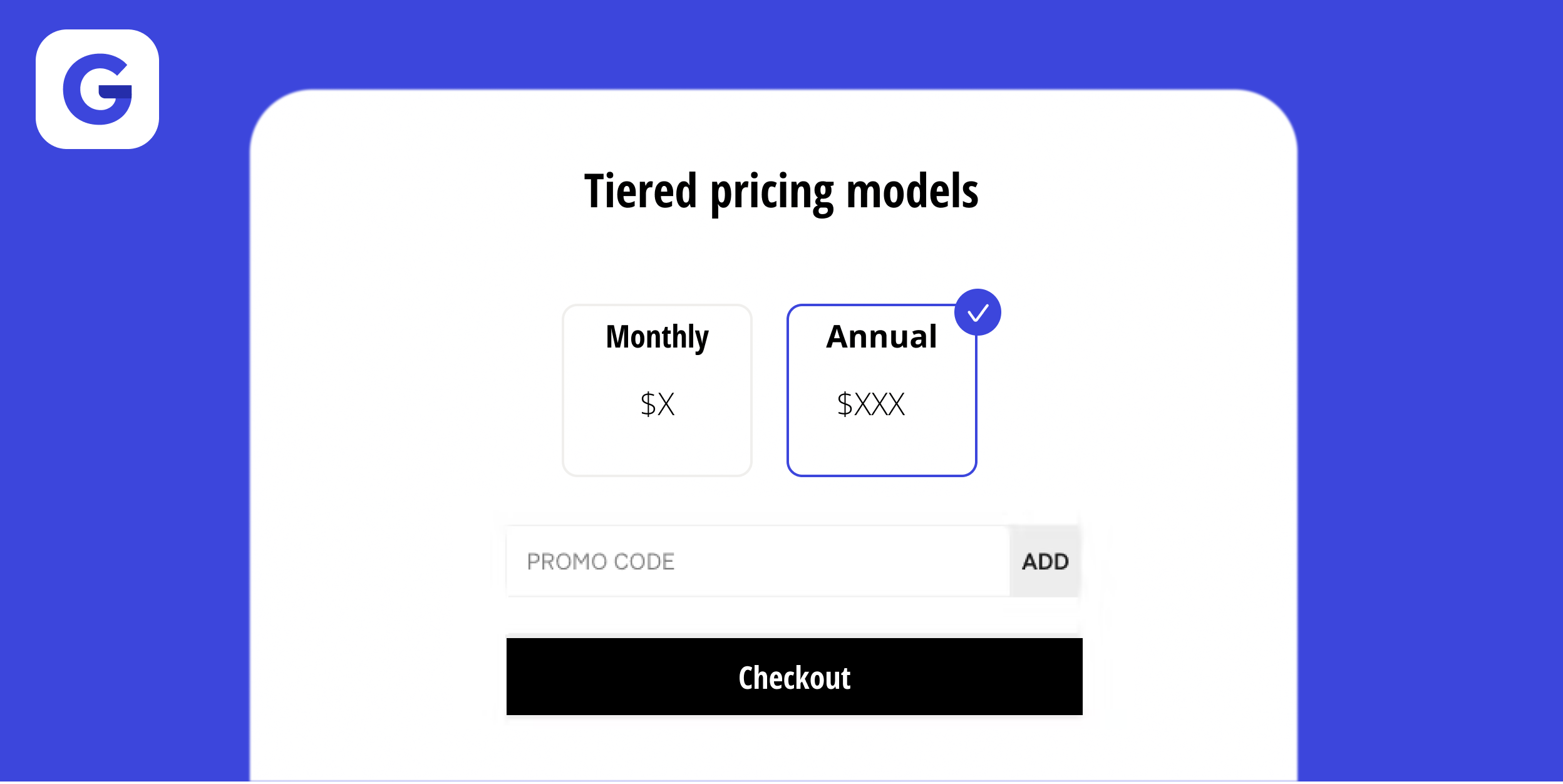

Understanding Subscription Billing Solutions

Subscription billing has become increasingly popular in recent years, with more and more businesses adopting this model to offer their products or services. From streaming platforms to software companies, subscription-based business models have proven to be successful and profitable. However, managing subscription billing can be complex and time-consuming without the right solution in place. In this blog post, we will dive deep into the world of subscription billing solutions and explore why bu

Why Businesses Need Recurring Billing Software in 2024

In today's fast-paced business environment, businesses are constantly looking for ways to optimize their processes and improve their bottom line. One area where efficiency can be greatly enhanced is in billing and payment management. Recurring billing software offers a powerful solution for businesses that have recurring revenue streams, such as subscription-based services or membership programs. With the ability to automate invoicing, manage subscriptions, and integrate with multiple payment g