Zeller Invoices: A New Online Invoicing Solution for Australian Businesses

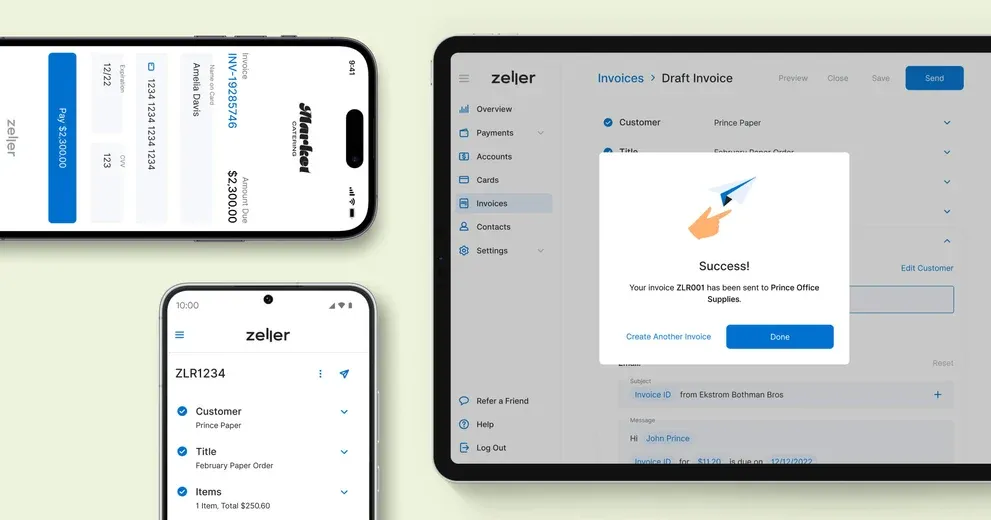

Zeller, the Australian fintech reimagining business banking, has launched a new online invoicing solution. Zeller Invoices is a free and unlimited service that allows businesses to send invoices, automate reminders, and track payment history. Zeller Invoices is a valuable addition to Zeller's growing product suite, which also includes EFTPOS, transaction accounts, and debit cards. With Zeller Invoices, businesses can now manage their finances and payments more easily, all from one place. What

by Growpay

Zeller, the Australian fintech reimagining business banking, has launched a new online invoicing solution. Zeller Invoices is a free and unlimited service that allows businesses to send invoices, automate reminders, and track payment history.

Zeller Invoices is a valuable addition to Zeller's growing product suite, which also includes EFTPOS, transaction accounts, and debit cards. With Zeller Invoices, businesses can now manage their finances and payments more easily, all from one place.

What makes Zeller Invoices different?

There are a few key things that make Zeller Invoices different from other online invoicing solutions. First, it is free and unlimited. Businesses can send as many invoices as they need, without any monthly fees or hidden charges.

Second, Zeller Invoices is integrated with Zeller's other products. This means that businesses can see all of their cash inflows and outflows in one place, making it easy to track their financial health.

Third, Zeller Invoices offers a number of features that help businesses get paid faster. For example, businesses can automate reminders to send to customers who have not yet paid their invoices.

How can businesses benefit from Zeller Invoices?

Zeller Invoices can help businesses in a number of ways. First, it can help businesses to get paid faster. By automating reminders and tracking payment history, Zeller Invoices can help businesses to reduce the number of late payments.

Second, Zeller Invoices can help businesses to save money. The low card processing rate offered by Zeller Invoices can help businesses to save money on their payment processing fees.

Third, Zeller Invoices can help businesses to improve their cash flow. By providing businesses with a clear overview of their finances, Zeller Invoices can help businesses to make better financial decisions.

With Zeller Invoices, businesses can:

- Send unlimited, free online invoices.

- Get paid faster, accelerating business cash flow by enabling customers to pay quickly and securely online.

- Customise invoice templates with business details, add due dates, and send automated reminders.

- Connect their online invoices with the rest of their business finances, using one account to access invoicing, EFTPOS, transaction accounts and debit cards.

- Grow their understanding of their customers by assigning invoices to customers and suppliers to track invoicing across their entire business database.

"We're excited to add Zeller Invoices to our growing product suite, which helps Australian business owners manage finances and payments more easily," said Ben Pfisterer, Zeller co-founder and CEO. "This product simplifies payment processing, reduces late payments, and saves time, all without any monthly fees or lock-in contracts. With a low card processing rate, businesses can save money and get paid faster."

Zeller Invoices is a valuable tool for businesses of all sizes. It is easy to use, affordable, and can help businesses improve their cash flow and customer relationships.

"As a business that takes both in-person and invoice payments, using a financial services provider that provides both tools is crucial – providing us with a comprehensive overview of our incoming funds," said Sara Kourkgy, General Manager of Precision Pharmacy in Sydney, an early adopter of Zeller Invoices. "We chose Zeller Invoices as it is easy to utilise and follows up overdue invoices on our behalf, so we can focus on managing our business and providing exceptional care for our customers."

If you are a business owner looking for a simple and effective way to send and track invoices, then Zeller Invoices is a great alternative and something worth considering.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them